WSLL @ Your Service February 2022

Contents

How to Find Federal Tax Decisions - Carol Hassler

Tax disputes are settled by administrative review and in federal courts. In this article, we'll take a quick dive into which courts hear federal tax cases and where to find decisions. To learn more about some of the resources discussed below and get state and federal tax research tips, sign up for our March webinar, Tax Research Sources and Strategies.

Court research

Federal courts interpret our nation's tax laws. Tax cases are heard in the U.S. Tax Court, U.S. Claims Court, federal district courts, the Court of Appeals, and the U.S. Supreme Court. Lower level courts include the U.S. Tax Court, district courts, and the U.S. Claims Court. While district courts and the U.S. Claims Court hear a variety of cases which may include tax cases, the U.S Tax Court is a specialist.

The U.S. Tax Court produces regular and memorandum decisions. Find limited dockets and decisions on their website, going back to 1986. Regular decisions from this court are published in the Reports of the United States Tax Court, but other publications and database may include both types of decisions. This court may also hear "small tax cases" for certain cases that meet a dollar limit and other criteria. Tax Court cases are appealed to the U.S. Court of Appeals, and then the U.S. Supreme Court.

District courts may hear tax cases, and those opinions can be found in federal reporters, specialized tax reporters, and online databases. The United States Court of Federal Claims may hear cases involving tax refunds, and those opinions can be found on their website as well as within databases or tax reporters. These lower level court cases may be appealed to the U.S. Court of Appeals, and then the U.S. Supreme Court.

Internal Revenue sources

The U.S. Department of the Treasury administers the tax laws of the United States. Internal Revenue Service rulings and memoranda may be used to provide authority or insight into the Treasury Department's view on some tax matters.

Revenue Rulings and Revenue Procedures are important sources of federal tax law. Revenue Rulings are official interpretations by the IRS of the Internal Revenue Code, related statutes, treaties, and regulations. Revenue Procedures are official statements of a procedure that affects the rights or duties of taxpayers and other members of the public and is deemed a matter of public knowledge. Both of these are published in the Internal Revenue Bulletin. You may see Revenue Rulings with a temporary or permanent citation, and they can also be found in publications like Merten's Law of Federal Income Taxation, the Federal Register, and tax reporters.

Letter rulings, on the other hand, are not officially published by the IRS. These types of rulings may include private letter rulings, technical advice memoranda, notices, and announcements. The IRS primer on the agency's issued documents provides more detail about why and when these are issued. Generally speaking, these types of documents aren't relied on as authoritative sources. However, they can provide insight into how the IRS might approach a situation. Written guidance from the IRS can be found online, or in tax reporters or databases.

Databases for tax research

Research tax cases in the library's print sources, or dive into online databases for quick access to decisions and analysis.

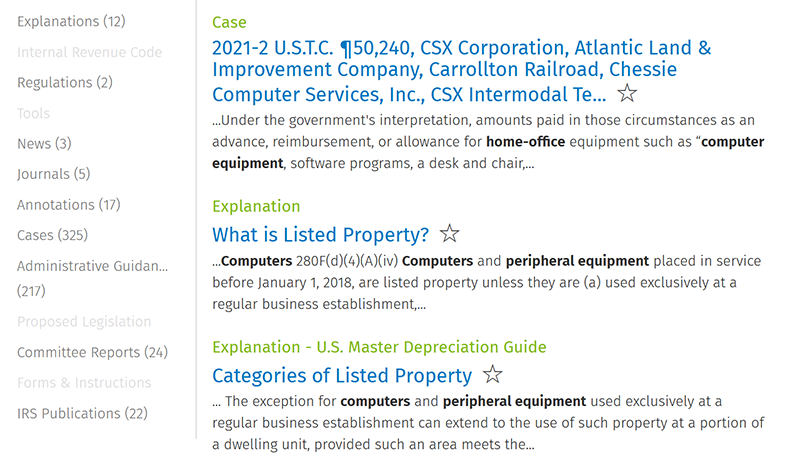

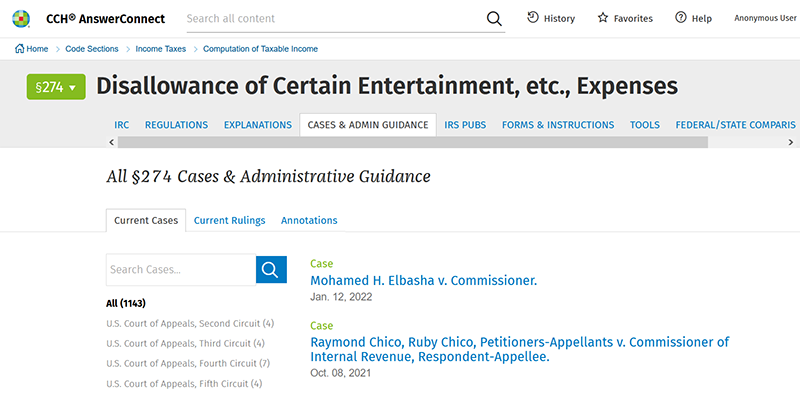

CCH AnswerConnect is available outside the library to all library cardholders. It's easy to use this database to find tax cases and IRS guidance. Enter a keyword search to find all sources on a given topic. Refine your search to cases and agency guidance using the filters on the left.

If you know the Internal Revenue Code (IRC) section you want to research, you can browse to that section and look for the "Cases and Admin Guidance" tab above the code section for current rulings and cases, which can be narrowed down by court or type of administrative guidance. As with any search on CCH AnswerConnect, you may browse by topic to find citations to relevant primary law, and then easily find cases and administrative guidance once you follow the link to the IRC section.

In the David T. Prosser Jr. library, researchers may use Westlaw, Lexis, or Bloomberg Law to research tax cases and IRS guidance. Westlaw is available to researchers on their own devices when they are connected to the law library wireless network. Researchers at our courthouse libraries, the Milwaukee and Dane County Law Libraries, have access to Westlaw on the public computers.

Ask a librarian

If you're stuck on a research question, ask a reference librarian for help. Send an email to wsll.ref@wicourts.gov or call us at 608-267-9696. Learn more about some of the resources discussed below and get state and federal tax research tips by signing up for our March webinar, Tax Research Sources and Strategies.

New Books - Kari Zelinka

New Edition! White Collar Crime 3rd edition, by Joel M. Androphy, 2021

Call Number: KF9350 .A932

White Collar Crime is a multivolume set that may prove useful while doing in-depth research, but is a bit unwieldy to tote around in its entirety. In the updated 3rd edition, it has been expanded to eight volumes. Volume seven, Trial Manual in White Collar Defense, contains the information you might most need in court.

Topics in volume 7 include:

- Strategies: Co-defendants, reports and depositions, witnesses, etc.

- Evidentiary issues: Acts & testimony, 6th amendments implications, & sample materials

- Preservation of Error: Voir Dire, exclusion of testimony, and jury instructions

- Alternate Theories of Liability: Aiding and abetting, conspiracy and sample material

- Jury Issues: Selection, issues during trial, and sample materials

New Update! Commercial and Consumer Transactions in Wisconsin 3rd edition 2021-22 rev., 2021

Call Number: KFW 2552 .C42

Do you represent Wisconsin businesses doing business outside the United States? Have you been asked about personal property leases for equipment, goods, and other tangible property? If you run into these scenarios and have questions, check out Commercial and Consumer Transactions in Wisconsin 3rd edition, recently published by the State Bar of Wisconsin. This text will give you a refresher on contract law, commercial paper and other aspects of business law in Wisconsin.

Topics include:

- Principles of contract: freedom on contract and choice of law

- Contract interpretation

- Performance or breach

- Remedies

- Wisconsin Consumer Act

- Three day right to cancel

- Lemon law

- Prize notices

- Sales

![]() See our latest New Titles list for a list of new books and other resources.

See our latest New Titles list for a list of new books and other resources.

For assistance in accessing these or other resources, please contact our Reference Desk.

Tech Tip - Heidi Yelk

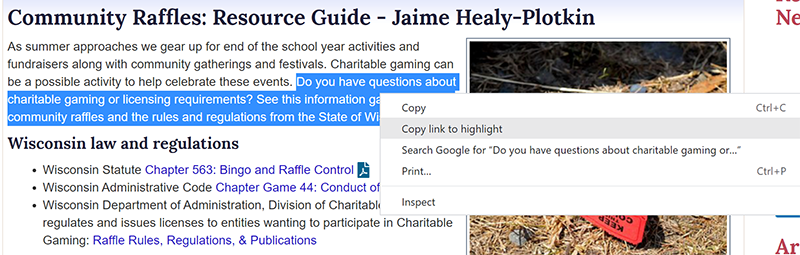

Make your point with "Copy Link to Highlight" in Chrome

If you routinely share information from webpages, you may be interested in Chrome's "Copy Link to Highlight" feature, released last year. When using the Chrome browser, simply highlight text, right mouse click and choose "Copy Link to Highlight" from the menu. Now you have a sharable link to paste in an email (or post) that will take readers directly to a specific spot on the page, with your selected text highlighted. For an example, see this page where the author explains a holding in Sorenson v. Batchelder.

This feature works for HTML webpages and only for readers who are also using the Chrome browser. Google is reportedly expanding this feature to photos and videos soon.

Library News - Carol Hassler

New Program Associate

We are pleased to announce that Abigail Case has joined the library as our new Program Associate. Abigail joins us from the nonprofit and retail industries, with a strong customer service background. We're excited for Abigail to join our team. For those readers who subscribe to get our newsletter via email, look for updates and emails from Abigail in the future! Welcome, Abigail!

Winter CLE Classes

Webinars for 2022 are now open for registration through the Wisconsin State Law Library. Registration for each webinar is limited to 100. Registrations will be approved daily by the moderator. Once your registration is approved, you will get an email confirmation with connection information. Please reach out to carol.hassler@wicourts.gov with questions.

Advanced Wisconsin Legislative History

Wednesday, February 9, 12:00 - 1:00 p.m.

Location: Live webinar - Register for Advanced Wisconsin Legislative History

1 CLE credit applied for

I need the legislative history of a Wisconsin statute. Where do I start? What do I do? Participants will look at the primary resources used to research Wisconsin legislative history, learn about the online Wisconsin legislative drafting files, and learn some helpful tips and tricks along the way. This advanced class covers additional search strategies, budget bills, advanced use of drafting records, and Supreme Court rule order research.

NEW! Tax Research Sources and Strategies

Thursday, March 10, 12:00 - 1:00 p.m.

Location: Live webinar - Register for Tax Research Sources and Strategies

1 CLE credit applied for

Tax research is always in season! Get an overview of major tax law databases available in the library or remotely with a library card. Learn about major sources for understanding federal and state tax law. Get tips for topical research using CCH AnswerConnect and major treatises. This class will survey tax decision sources and go over research strategies to find opinions by subject or citation.

February Snapshot

Justice

Photo by Francis X. Sullivan

Murals frame the first floor rotunda of the Wisconsin State Capitol. This month's featured photo is of one of four magnificent glass mosaics decorating the pendentives of the rotunda. Justice, featured here, contains around 100,000 pieces of glass and represents Wisconsin's judicial branch of government.

We are accepting snapshots! Do you have a photo highlighting libraries, attractions or points of historical interest? Send your photo to the editor at carol.hassler@wicourts.gov to be included in a future issue.

Comments Welcome!

- Contact Carol Hassler

608-266-1424

Keep Up With Current News

- Weekly updates with Library Highlights

Subscribe to our Newsletter RSS Feed

Subscribe to our Newsletter RSS Feed